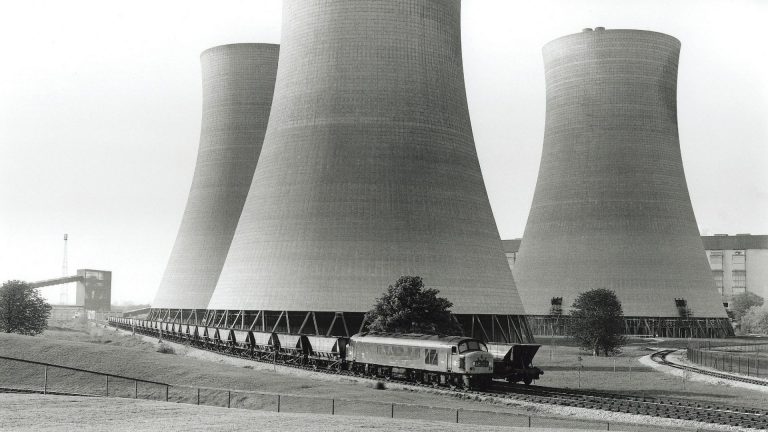

I was on holiday in France in 2008 when the local TV channel started its nightly news programme with pictures of Northern Rock. It took me a while to discover why a small regional former building society was such a major news story in Eastern France. By the time I got home from my hols, the world had started to crash around our ears.

Short-term borrowing to finance long-term lending, ever larger and stupider mergers, bonuses for spivs who came up with financial instruments that no-one could understand and with huge risks for those dumb enough to buy them and massive rewards for those who sold them. All managed by executives, who it turned out, were over-promoted, inept risk-takers without a single banking qualification between them.

When the financial system collapsed, they turned to their governments, the same governments they had lobbied endlessly for lighter regulation, more freedoms, and lower taxes, and begged, on their knees, for billions in taxpayer-funded bailouts.

The only thing that saved the world’s financial and economic system from total collapse was an international agreement, organised by Gordon Brown, to print and throw unlimited amounts of money at the economy.

When the dust settled the West’s governments decided that it had all been too close a call for comfort and started to regulate the financial system better, test the banks’ capacity to survive ever larger shocks and limit the bonuses which encouraged all that reckless and shameless speculation.

Now Rishi Sunak has confirmed he will go ahead with Liz Truss’s plan to scrap the cap on bankers’ bonuses that the EU introduced. In place since 2014, the measure will end on October 31.

Apparently, the system is now better regulated, the risks are much smaller and bonuses are not a danger to the financial system any longer. In fact, it seems now they are a way of attracting the brightest and the best back to the UK, many of them having left after Brexit.

Leaving aside the fact that in the middle of a cost-of-living crisis, a faltering economy, higher taxes and higher interest rates, the government is going to find the time to make sure that bankers can make even more obscene amounts of money, this is just asking for trouble.

The UK government and its financial regulators are planning to make the City of London a more attractive place to base your business, by allowing you to pay higher bonuses to your brilliant, expert, well-trained, law-abiding team of financial titans.

They are also going to do the same for every spiv, chancer, and con artist. Every reckless banker with a cunning scheme which will get him or her to the top of the greasy pole, will want to be based in London.

The UK’s regulators think they can deal with any problems, and have the powers and the oversight necessary. We had better hope they are right because putting up a sign saying “lower regulation here than elsewhere” is going to attract lots of people with very dodgy motives.

But don’t worry the UK’s financial system is not going to collapse again, any time soon. It takes years, if not decades, for the pressures to build up, the regulators to relax, the bankers to lobby for an ever-lighter touch, the shysters to invent new ways of fleecing the system.

But the UK has lit the touch paper and remember just like with the last crash any future credit crunches will be paid for by you. Not the bankers, not the long-retired regulators and the elder statesmen in the House of Lords.

By you, again.