There is a famous old quote from Hemingway’s The Sun also Rises when one character is asked how he went broke. “Two ways,” he replies. “Gradually and then suddenly.” That remark captures perfectly how debt can be manageable – right up until the moment when it is not.

You can go from having assets and security to losing it all with just a few bad decisions. The worse things get the more the banks will demand in security, the higher the borrowing costs and fees and the fewer the number of people willing to take a risk on you.

Which brings us to Thames Water, which is not quite reduced to pawning the family silver and doing deals with the local loan shark, but is not far off.

Now a notorious US hedge fund which as the FT politely puts it is “known for circling distressed assets” is one of several bond holders of Thames which have agreed to lend the water giant £3bn. Without the money, Thames could run out of money by Christmas, which given that it is now having to borrow money from hedge funds, might be the more sensible option.

When you are dependent on borrowing short term from US hedge funds you are far from shore, surrounded by sharks and bleeding profusely. Your prospects are not good. Even the fact that rival groups of hedge funds are competing to lend Thames the money is not good news. Feeding frenzies never are.

Thames, which used to be one of the most secure and safest bets for any lender, is now looking to borrow at an eye-watering rate of almost 10%.

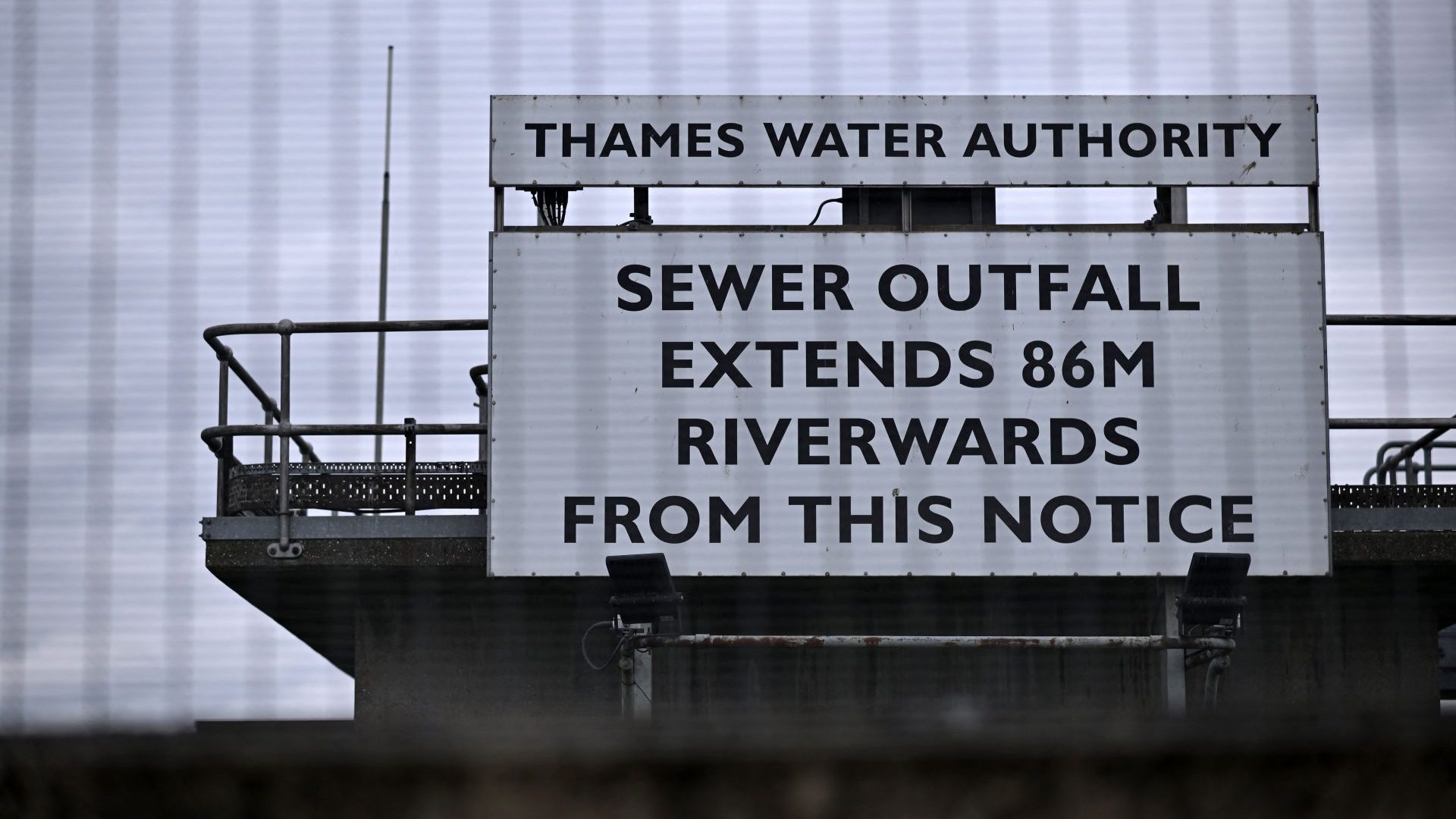

This is perhaps the most glaring example of everything that has gone wrong with the privatisation of Britain’s water industry. It is Ofwat that’s really to blame for the disastrous mess.

Successive governments have allowed regulatory capture to take place; where the industry which is supposed to be under the thumb of an independent watchdog instead outspends the regulator, poaches its staff by offering them huge salaries and lobbies to weaken it to the point of irrelevance.

Every Ofwat official who has been headhunted by a water company, every boss who has lobbied for weaker controls and every investor who has hired lawyers to find ways around regulation is to blame for this mess. If at any time a single government minister had seen what was inevitable and decided to act, we wouldn’t be here either.

Banning Ofwat staff from ever working in the water industry, giving it real teeth, an unlimited legal budget, blocking foreign takeovers and appointing a rottweiler as boss might have saved the day.

But instead, water companies developed huge webs of complicated ownership, became loaded with debt and stripped of money, which was used to pay dividends.

And here we are.

Thames has debts of £19bn and has taken out a loan to see it through to Christmas. Meanwhile they are digging up streets around London every day to temporarily mend the capital’s collapsing water infrastructure.

I am sure we all wish Thames Water a happy New Year.