For the next four weeks Rachel Reeves, like the rest of us, will be stuck in the hellscape of fiscal politics. Fiscal politics, in case you haven’t noticed, involves all parties, at all times, claiming they will meet self-imposed rules on spending and borrowing, thus constraining all ambition, feeling and – as we’ve seen from Cameron to Sunak – economic growth.

My hunch, however, is that once in power Reeves will be faced with a problem few people are anticipating: too much growth.

Unlike the Office for Budget Responsibility, which thinks investment-led growth strategies do not work, Reeves has bet Labour’s farm on the idea that rapid deregulation – of housebuilding, energy, infrastructure and tech innovation – can kickstart growth, without needing a huge borrow and spend programme.

And I think she is right. If Labour can light a bonfire of the obstacles to investment, and put a rocket under the institutions like the National Grid, there is every chance that a slew of foreign money will flood into UK business.

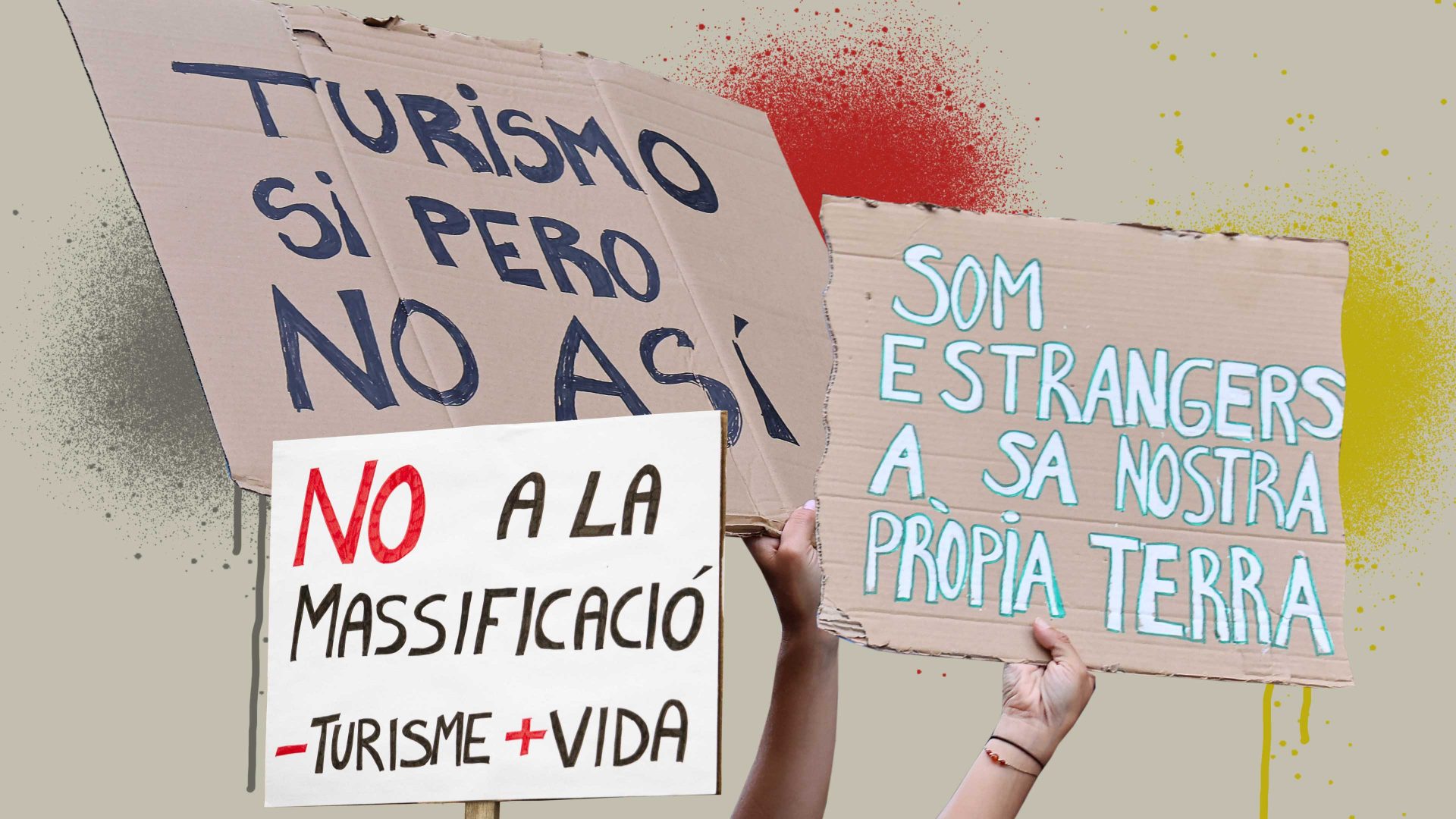

Add in some new towns, this time without years of planning objections, and the main obstacle to fulfilment will be labour shortages. Because, as every business knows, we are already massively short of skills at every level. And that, in turn, will drive up wages.

If you look at what’s happened to wages during the post-Covid recovery, something counterintuitive emerges: though most people still call this a “cost of living crisis”, real wages have surged by 2% over the past year. And that has happened alongside non-EU migration that has added about a million people to the workforce in the past 24 months. At the same time, the economy itself has been close to stagnation.

We don’t know what work-visa rules Labour will maintain if it takes power, but if it only keeps them roughly the same while achieving low-inflationary growth for a couple of years, the resulting labour shortage means the real winners will be workers.

Freya Beamish, chief economist at TS Lombard, thinks this is already happening in the USA. In a recent research paper published in April, Climbing a Wall of Inflation Worry, she argues that Joe Biden’s programme of state-directed green infrastructure investment has produced a “virtuous cycle” between rising real wages and rising productivity. Real wage rises stimulate demand and investment, while rising productivity means business can, for now, afford their higher pay bills.

If it sounds familiar, it is the condition that underpinned the post-war boom. While some economists worry it is a fleeting coincidence for the USA, the fact remains that US productivity has grown between 4% and 6% a year in the post-Covid era, massively outstripping its developed-world peers, while creating millions of new jobs.

The UK, of course, lives within different constraints. We are suffering from the negative effects of Brexit, and from the stagnation of the neighbouring Eurozone, and from a workforce where participation rates are depressed by the crisis in public health. And unlike Joe Biden, Rachel Reeves cannot borrow against a global reserve currency.

But Beamish thinks the UK stands a better chance than any of its European neighbours of pulling off a wage growth/productivity growth trick. We’re the only country in Europe where real output per hour has moved discernibly above 2019 levels, while real pay growth is running at 2% over the past year.

To sustain it, if it begins, Reeves will need to hold her nerve on several fronts. Her strategy of “crowding in” private investment alongside public money will, ipso facto, stimulate wage growth in the private sector: think nuclear power, wind turbines, a revived steel and defence industry. That, in turn, will create upward pressure on inflation.

Instead of simply relying on the Bank of England to curb inflation, Reeves should look for a strategic incomes policy with the unions in the private sector.

To understand what is achievable, you have to look at Reeves’ project – dubbed “Securonomics” – as a phased endeavour. First, remove the planning obstacles and prime the pumps for investment with judicious small chunks of public money; and simultaneously, train the new workforce.

In Phase Two, where small nuclear reactors, new towns, windfarms and the submarine industry are all clamouring for the same, skilled, manual labour, you need the unions on board as partners to help manage both training and the reallocation of labour between sectors, and prevent wages from driving inflation into dangerous territory.

In Phase Three, you get lift off: the new towns are populated, local green energy projects begin to slash some household bills, while the rising wages of non-graduate workers drives an uplift in material wellbeing and tax revenues rise.

After the clown show of Tory economic policymaking over the past 14 years, veering from needless austerity to crazed fiscal giveaways, many people will rub their eyes in disbelief if Reeves pulls it off. There are workers in mid-career who have never actually experienced conditions of rising prosperity alongside technological progress.

It could be derailed by many things: an obdurate Bank of England; an OBR that refuses to believe investment can drive long-term growth. But ultimately the biggest obstacle could be Labour’s reluctance to believe that a virtuous cycle is achievable. They are cautious: rightly scarred by the Truss debacle and determined to enforce fiscal discipline in the pre-election period.

But if we do see a simultaneous rise in GDP growth, productivity and wages during the first 18 months of the Labour government, its decision-makers will have to learn what all good gardeners learn: don’t prune too soon. Let the virtuous interaction of rising demand and investment happen.